Accounting is shifting from manual data entry and reconciliation to software driven, rule based, and AI assisted workflows. This article shows you what automated accounting is, where it drives measurable ROI, which processes to automate first, and the exact steps to roll it out with strong controls.

You will find a clear definition, a benefits checklist, a prioritized process map, a six step implementation playbook, common risks to avoid, and a quick look at popular tools such as QuickBooks, NetSuite, Tipalti, Spendesk, and Xero. We, close with our team at Makeitfuture, help you deliver results faster with low code and no code.

WHAT IS AUTOMATED ACCOUNTING?

Automated accounting is the use of software, AI, and workflow automation to capture, classify, approve, reconcile, and report financial transactions with minimal manual touch, while maintaining audit trails and controls. It combines capabilities such as data extraction, rules engines, integrations, and analytics to streamline core finance tasks end to end. For context, McKinsey estimated that about 42 percent of finance activities can be automated with current technology, highlighting the significant potential for efficiency and accuracy gains.

BENEFITS OF AUTOMATED ACCOUNTING

Automation frees your team from low value keystrokes and firefighting so they can focus on analysis, decisions, and partnering with the business. The gains are not abstract, they are measurable in cycle time, accuracy, and cash performance.

- Faster cycle times. Best in class AP teams process invoices in a fraction of the time of peers when automation is deployed, improving on time payments and supplier relationships.

- Lower cost per transaction. Automated capture, matching, and approvals reduce touches per invoice and per expense, cutting processing costs materially.

- Fewer errors and rework. Rules based validation and machine learning assisted data capture reduce keying mistakes and exceptions, improving first pass match rates

- Real time visibility. Integrated data flows and dashboards surface spend, cash, and revenue insights daily, not weeks after close.

- Stronger compliance and auditability. Automated segregation of duties, approvals, and immutable logs support SOC 1 controls and reduce audit effort.

- Improved working capital. Faster billing and collections reduce DSO; touchless AP enables early payment discounts and avoids late fees.

- Scalability. Volumes can grow without linear headcount increases, which matters during peak periods and expansion.

- Fraud risk reduction. System enforced policies, vendor validation, and anomaly detection help mitigate losses, a real concern given organizations lose an estimated 5 percent of revenue to fraud annually.

- Employee experience. Finance talent spends more time on analysis and business partnering, less on manual reconciliations and chasing approvals.

CORE ACCOUNTING PROCESSES TO AUTOMATE

Start where transaction volume, manual touches, and errors are highest. Then build toward a continuous accounting model where data flows daily and the month end crunch disappears.

- Accounts payable. Intelligent invoice capture, 2 and 3 way matching, policy based approvals, and automated payments with remittance advice.

- Employee expenses and cards. Receipt OCR, automatic coding, policy enforcement, and real time card feeds with spend controls.

- Accounts receivable. Automated invoicing, collections workflows, cash application from bank feeds, and dunning sequences by risk segment.

- Bank reconciliation. Daily bank feed import, rules based matching, and exception workflows to cut month end effort.

- Journal entries. Recurring entries, accruals, allocations, and intercompany eliminations generated from schedules and rules.

- Revenue recognition. Schedules for subscriptions, milestones, and usage to meet ASC 606 and IFRS 15 requirements.

- Tax compliance. Automated VAT or sales tax calculation and filing workflows; 1099 reporting with vendor TIN validation.

- Procure to pay. Vendor onboarding, W9 collection, risk checks, purchase requests, and PO creation tied to budgets.

- Close and consolidation. Task orchestration, checklist automation, variance analysis, and auto certification of reconciliations.

- Management reporting. Scheduled reports and self service dashboards sourced from the general ledger and subledgers.

Guidance: automate the data capture and decision points first, then the money movement, and finish with reconciliations and reporting. This sequence maximizes business value and control.

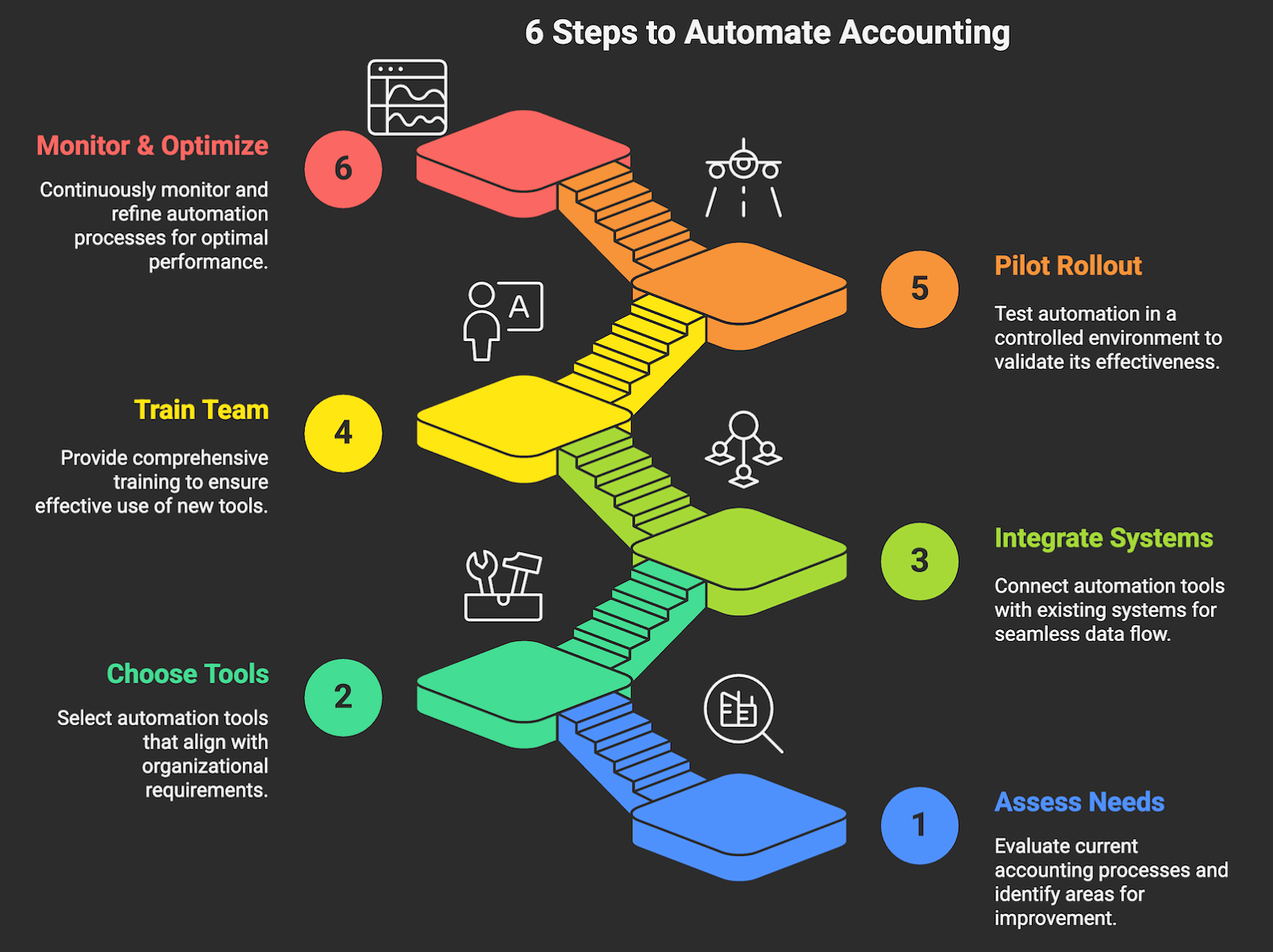

AUTOMATE ACCOUNTING PROCESSES IN 6 STEPS

Use a structured playbook to reduce risk and accelerate value. The steps below work across SMBs, SaaS companies, and complex enterprises.

- Assess your organization’s accounting needs.

- Map processes end to end. Capture volumes, system touch points, cycle times, and error hot spots.

- Baseline KPIs: cost per invoice, days to close, DSO, first pass match rate, exceptions per 1,000 transactions.

- Clarify constraints: audit requirements, segregation of duties, data residency, and industry specifics like ASC 606.

- Build a business case. Estimate savings from reduced touches and faster cycles, plus risk reduction and growth capacity.

- Choose the right automation tools.

- Fit for purpose: does the tool natively support your use cases, currencies, and entities; does it handle your volume profile.

- Controls: approvals, logs, roles, and audit exports that support SOC 1, SOX, and internal policies.

- AI capability with guardrails: document AI for invoices and receipts; anomaly detection; explainability and confidence scores.

- Total cost of ownership: licenses, implementation, integrations, internal admin time, and expected ROI over 12 to 24 months.

- Integration with existing systems.

- Use vendor APIs or iPaaS to connect ERP, CRM, banking, payroll, and data warehouse. Avoid manual file hops.

- Harden master data: suppliers, customers, chart of accounts, cost centers, tax codes. Clean data multiplies automation benefits.

- Identity and access: SSO, SCIM provisioning, least privilege, and segregation of duties enforced at the platform level.

- Security standards: align with the NIST Cybersecurity Framework and ISO 27001 where applicable. Document data flows and storage locations.

- Training your team and managing change.

- Define new roles. Who owns exceptions, bot run books, and vendor master data stewardship.

- Deliver role based training with real transactions. Reinforce controls, not just clicks.

- Communicate the why. Emphasize time back to focus on analysis and partnering with the business.

- Create a feedback loop. Weekly office hours and a backlog for improvements.

- Pilot, measure, and phase your rollout.

- Start with a high volume process in one business unit or entity. Prove the data flow, controls, and exception handling.

- Track KPIs from step one and validate the business case. Expand in waves once the pilot is stable.

- Codify lessons learned into standards and templates.

- Best practices for monitoring and optimization.

- Set SLOs for cycle time, error rate, and system uptime. Instrument with dashboards and alerts.

- Review exceptions weekly. Update rules and training data to drive down repeats.

- Quarterly control reviews with Internal Audit. Keep SOC 1 narratives current as automations evolve.

- Continuously prune. Stop automations that no longer pay back, and double down on the winners.

CHALLENGES AND RISKS OF AUTOMATED ACCOUNTING

Automation improves control when done right. It can also amplify problems if data, design, or governance are weak. Tackle these head on.

- Data quality and master data drift. Inconsistent vendor names, tax codes, or account mappings cause exceptions and mispostings. Fix with data stewardship, validation rules, and scheduled deduplication.

- Over automation without human review. Touchless posting of all journals increases risk. Set thresholds and require approvals for high value or high risk entries.

- AI model risk. Document extraction and anomaly detection models can drift. Monitor accuracy, keep a human in the loop for low confidence cases, and log decisions for audit, aligned to the NIST AI RMF.

- Segregation of duties gaps. New workflows can accidentally let one person request, approve, and pay. Use role based access and periodic access reviews mapped to SOC 1 controls.

- Vendor and integration risk. Outages or API changes can break flows. Use retries, circuit breakers, and vendor SLAs; keep fallbacks like CSV upload paths documented.

- Regulatory change. Tax rules, eInvoicing mandates, or privacy laws evolve. Assign an owner to track changes, and prefer vendors with frequent compliance updates.

- Shadow IT. Teams may spin up unmanaged automations. Establish a center of excellence, a review board, and a secure catalog for approved workflows.

- Hidden costs. Excess “bot minutes”, premium connectors, or manual exception handling can erode ROI. Instrument costs and automate the automations, for example, auto archiving and log rotation.

POPULAR TOOLS AND TECHNOLOGIES FOR AUTOMATED ACCOUNTING

Tool choice should be driven by your operating model, complexity, and growth plans. Below is a quick comparison of five widely used platforms.

How low code and no code platforms automate accounting

Low code and no code platforms let you orchestrate workflows that span multiple systems quickly, without heavy custom development. Common options include Microsoft Power Automate, Zapier, Make, and Workato, plus RPA when screen interaction is unavoidable.

- Typical use cases: invoice data extraction with AI, routing for approvals, auto posting journals via API, cash application from remittance emails, scheduled reconciliations, and alerting on anomalies.

- Design principles: use APIs where possible, keep business rules centralized, log every action for audit, and enforce role based permissions.

- Guardrails: set rate limits, retries, and DLQs for resilience; version workflows; and align to your change management process.

CHOOSE MAKEITFUTURE AS YOUR AUTOMATION PARTNER

Bottom line. Automated accounting delivers faster cycles, lower costs, stronger controls, and real time visibility when you pair the right tools with disciplined implementation. Start with high volume processes like AP and AR, integrate cleanly with your ERP and banks, keep humans in the loop for risk, and measure relentlessly. The result is a finance function that scales and partners better with the business.

If you want an experienced guide, Makeitfuture helps finance and ops leaders design, build, and scale intelligent automations with low code and no code. We run discovery to quantify ROI, select the right platforms, implement with strong controls, and upskill your team so you own the capability. Explore our services, and see outcomes in our case studies, including projects that connect QuickBooks or Xero with AP automation, and NetSuite with global payout solutions like Tipalti.

.png)

.png)

.avif)